PRESUMPTIVE TAXATION UNDER INCOME TAX ACT,1961

Ø INTRODUCTION:

There is substantive increase in

small businesses with the growth of transport and communication and the general

growth of the economy. To smooth the procedures and taxation aspects for such

small industries a new aspect called Presumptive Taxation came in to force

under income tax act. Presumptive taxation under

income tax act, 1961 means a form of assessing tax liability using indirect

method/presumptive method or on assumption basis. The

term "presumptive" is used to indicate that there is a legal

presumption that the taxpayer's income is no less than the amount resulting

from application of the indirect method. It is the taxation based on ‘average

income’ instead of actual income which differs from usual rules based income. Presumptive methods of taxation are thought to be

effective in reducing tax avoidance as well as equalizing the distribution of the tax

burden.

The

interesting thing to know that all the section related to Presumptive taxation

is optional for the assesees or persons. It is not binding to any class of

business but once adopted all the provisions must be followed.

Ø APPLICABILITY :

The

applicability of presumptive taxation is to certain small class of business

activities to which section 44AB is not applicable i.e. section of Tax Audit. Thus,

this presumptive taxation is

applicable only to the income chargeable under the head of “profit and gains

from business and profession” means assesses, entitle to computation on

presumptive basis, cannot avoid tax on income from the head of other sources of

incomes by claiming it to be part of business income e.g. income on fixed

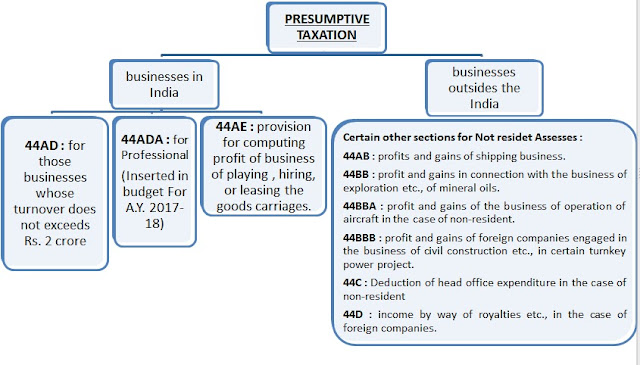

deposit. The act as covered the whole topic into certain sections and

provisions. The brief overview of such areas can be drawn in following chart.

Ø SECTIONS

IN BRIEF:

1.

44AD : Special provision for computing profit

of business under presumptive basis

§ This section is applicable

to individual, HUF, partnership firm excluding LLP and who covered in sec.44AE

playing, hiring, or leasing the goods carriages.

§ The business should

not covered under the provisions of 44AB i.e. turnover of the business should

not exceed Rs. 2 crore. [Amended in budget For A.Y.

2017-18 . earlier limit was Rs. 1 crore. As well as assessee must follow the

scheme for continuously for five years after adoption.]

§ The taxable income of

the business is calculated at 8% of total turnover of the business or any

higher amount voluntarily declared income.

§ Deduction under

section 80CCU & 80U shall be allowed. In case of partnership firm salary

and interest to partner shall be allowable for deduction. Any other expenditures

are not allowed for deduction.

§ Assessee shall not require

maintaining his books of account under section 44AA and books of account

audited under section 44AB.

2.

44ADA: Special

provision for computing profit of Professionals under presumptive basis

§ The benefit of Presumptive

Taxation which was earlier available only to specified businesses has now been

extended to Professionals. A professional who’s Total Gross Receipts do not

exceed more than Rs. 50 Lakhs in a financial year can claim benefit of this

Section from Financial Year 201617 onwards.

§ The Income of any person

making use of this Section would be assumed to be 50% of the Total Gross

Receipts for

the

year.

§ Assessee shall not require

maintaining his books of account under section 44AA and books of account

audited under section 44AB.

§ Deduction under

section 80CCU & 80U shall be allowed. In case of partnership firm salary

and interest to partner shall be allowable for deduction. Any other expenditures

are not allowed for deduction.

3.

44AE: Provision for

computation of income of estimated basis for people engaged in transport

business.

§ It is applicable to

that assesses who engaged in the business of hiring, playing, or leasing the

goods carriage but not more than 10 goods carriage at any time in previous

year. It is also apply to goods carriage taken on hire purchase or on

installment.

§ Estimated profit will

be taken as follows………

A.

Rs.5000/- per month or part of the month, per

truck, for heavy goods vehicle. (Heavy goods carriage means weight exceed 12MT).

However from 01.04.2015 the amount of profit is increased to Rs.7500/- as per the Finance (No. 2 ) Act, 2014.

B.

Rs.4500/- per month part of the month, per truck, for other

than heavy goods carriage

§ Assessee shall not

require maintaining his books of account under section 44AA and books of

account audited under section 44AB.

§ Deduction under

section 80CCU & 80U shall be allowed. In case of partnership firm salary

and interest to partner shall be allowable for deduction. Any other expenditures

are not allowed for deduction.

4.

44B: Provision for computing profits and gains

of shipping business in the case of non-

resident.

§ In the case of

non-residents, such profits and gains will be taken at an amount equal to 7.5%

of the amount paid or payable to the non-resident or to any other person on his

behalf on account of the carriage of passengers, live stocks,

mail or goods shipped at a port in India

also amount received or deemed to be received in India on account of the

carriage of passengers, live stocks,

mail or goods shipped at any port outside

India.

§ Section 172, which is

complete code itself, contains provisions for taxation of occasional shipping

business of non-resident in respect of profits made by them from carriage of

passengers, live stocks,

mail or goods shipped at a port in India.

5.

44BB: Special

provision for computing profit and gains in connection with the business of exploration etc., of mineral

oils.

§ It contains special

provisions for computation of taxable income of a non-resident assessee engaged

in business of providing services or facilities in connection with or supplying

plant and machinery on hire, used or to be used, in the prospecting for, or extractions

or production of mineral oils.

§ It provides that 10%

of the amount paid or payable to, all the amount received or receivable by the

assessee for provision of such services of facilities or supply of plant and

machinery shall be deemed to be the taxable income os such known resident

assessee

§ “Plant” means ships, aircraft, vehicles,

drilling units, scientific apparatus and equipment, used for the purpose of the

said business.

§ “Minerals” means

petroleum and natural gas.

6.

44BBA: Provision for

computing profit and gains of the business of operation of aircraft in the case

of non-resident.

§ It contains special

provisions for computing profits and gains of the business of operation of

aircraft of non-resident.

§ Taxable Income is

considered at the flat rate of 5% of the amount received or receivable for carriage

of passengers, live stocks, mail or goods from any place in India

or amount received or deemed to be received within India on account of the such

carriage from place outside India.

7.

44BBB: Provision for computing profit and gains of foreign companies engaged

in the business of civil construction etc., in certain turnkey power project.

§ The income of foreign

companies who are engaged in the business of civil construction or erection or

testing or commissioning of plant or machinery in connection with a turnkey

power project shall be deemed at 10% of the amount paid or payable to such

assessee or to any person on his behalf, whether in or out of India.

§ For this

purpose, the turnkey power project should be approved by the central

government.

§ It has also been

clarified that erection of plant or machinery or testing or commissioning

thereof will include lying of transmission lines and systems.

8.

44C :

Deduction of head office expenditure in the case of non-resident

§ In the case of Non-resident

who carry on business in India through their branches.

§ The deduction in respect of head office expenses will be limited to:

a)

An amount equal to 5 per cent of the “adjusted total income” for the relevant year: OR

b)

The actual amount

of the head office expenditure attributable to the business in India whichever

is less.

§ Adjusted total income

means a income before applying unabsorbed depreciation, unabsorbed business loss,

deduction u/s 80C to 80U.

§ “Head office

expenditure” means executive and general administration expenses incurred by

the assessee outside of India.

9.

44D: Provision for computing income by way of royalties etc., in the case of

foreign companies.

§ Royalties and fees

for technical services received from the government or an Indian concern by a

non-resident or a foreign company in

pursuance of an agreement entered in pursuance of an agreement entered into

after 31st march , 2003 shall be computed under the head “business

income” in accordance with the provisions of

the income tax act.

I.e. after allowing deduction for various permissible

expenses and allowances.

DIRECTOR OF INCOME TAX

(INTERNATIONAL TAXATION) vs. FMARINE CONTAINER LINES NV

v The

issue stands covered by the judgment in the case of Balaji Shipping UK Ltd.,

wherein it was held that slot hire agreements have been and remain a regular

feature of the shipping industry for decades. Whether they constitute a charter

of a portion of a ship or not is a different matter. In a case of the first

type, the carriage of goods by availing of the slot hire facility is an

integral part of the contract of carriage of goods by sea. Without it, the

enterprise / assessee would be greatly hampered in its business in relation to

international traffic, carriage of goods by sea.

v Enterprises

operating in any mode or manner, do not always ply their ships all over the

globe. Even if they do, their ships may not be readily available when required

on a particular route in connection with a contract of carriage of goods. It is

necessary, therefore in such cases for them to resort to slot hire agreements.

This enables them to transport the goods not on behalf of the owner of the

vessel which has granted them a slot hire facility, but in their own name on

behalf of their clients.

v The

contract of carriage of goods by sea is thus performed by such enterprises on a

principal to principal basis with their clients and not as agents of the owners

of the ships and/or their clients. The slot hire agreements are therefore, at

least indirectly, if not directly, connected and interlinked with and an

integral part of the enterprise's business of operating ships. Without availing

slot hire facilities, an enterprise would be unable to carry on its business of

operating ships in international traffic at all in many cases. They may well

loose much of their business. Even if business expediency is irrelevant to the

interpretation of the DTAA, it indicates the close nexus between slot hires and

the business of operation of ships in international traffic. If the DTAA is

construed to include activities directly or indirectly connected to the

operation of ships, it would include slot charters.

v By

availing the facility of slot hire agreements, the enterprise does not arrange

the shipment on behalf of the owner of the said vessel, but does so, on its own

account on a principal to principal basis with its clients. Such cases also

have a nexus to the main business of the enterprise of the operation of ships.

They are ancillary to and complement the operation of ships by the enterprise.

Inland Haulage Charges earned by

Foreign Company from it’s

customers in respect of transportation of goods from Inland Container Depots (ICDs) to Port where

goods were loaded in ships for international traffic are part of income derived

from operation of ships, and are covered

under Article 8 of DTAA and thus not taxable as business profits in India.

Ø CONCLUSION:

As per the above discussion,

we can conclude that presumptive taxation is helpful to both –to the revenue

department as well as to the businessmen. Assessing officers can reduce their

work burden to the minimum level as there is simple method of assessment of incomes

and other assessment procedures. As there is no requirement of book keeping,

simple method tax calculations and other less burden of administrative and

other paper work, businessmen can also reduce their work burden to a great

extent. And as it is simple method of taxation it inspires the persons to pay

tax regularly. However, one interesting thing to know that though, it is easy

and simple way, it can become a way of tax evasion. As there is no book

keeping, businessmen can show wrong incomes and expenses in their profit and

loss account. This provision of this act

is beneficial to small scale industries working at a lower level and it also

encourages foreign industries to develop their business in India.

THANK YOU.

[Note: This article is done with the help of my senior article assistant named Princy Mehta. Thanks for your kind support.]

Comments

Post a Comment